Unggulan

- Dapatkan link

- Aplikasi Lainnya

Blackout Period Insider Trading

Outside of finance a blackout period may also refer to a period of time in which a political party is unable to run advertisements. The restrictions are implemented to reduce the risk of insider trading by insiders who have access to nonpublic information.

Define Trading Blackout Period.

Blackout period insider trading. Firms particularly issuers may also establish policies that designate periods during which trading in specified securities is permitted windows and periods in which it is not blackouts. In addition to the Blackout Periods described above the Company may announce special Blackout Periods from time to time. INSIDER TRADING AND BLACKOUT PERIODS POLICY PURPOSE OF THE POLICY It is illegal under the laws and regulations of Canada the United States and other jurisdictions to trade in shares and other securities while in possession of privileged or material undisclosed.

A trading blackout period is a time period during which the company prohibits Section 16 insiders and other employees and consultants who have access to material nonpublic information about the. Ad Traden wie es zu Ihnen persönlich passt. A for quarterly financial results the period beginning at the end of the trading day that is two 2 weeks prior to the end of the quarter and ending at the end of the first full trading day after the financial results are publicly disclosed.

In the United States US for example the US. Sama will impose a blackout period if there is a pending undisclosed material development on all Insiders where they are prohibited from trading. With company stock a Read More.

I regularly scheduled blackout periods means a period beginning on the fifth day prior to the day on which the Corporation releases its annual or quarterly financial results and ending at the close of business on the first trading day following such release of annual or quarterly financial results. Trading Restrictions and Trading Blackout Periods It is illegal for anyone to purchase or sell securities of any public company with knowledge of material information affecting that company which has not been publicly disclosed. At most publicly traded firms an insider trading policy ITP establishes a pre-specified open trading window each quarter when insiders are allowed to trade which dictates a corresponding blackout period in which they are prohibited from doing so.

A Except to the extent otherwise provided in paragraph c of this section it is unlawful under section 306a1 of the Sarbanes-Oxley Act of 2002 15 USC. It is most commonly used to prevent insider trading. The Corporation will impose a blackout period if there is a pending undisclosed material development on all Insiders where they are prohibited from trading.

69 der CFD-Kleinanlegerkonten verlieren Geld. The insider trading policy should establish trading blackout periods. There are two main categories of blackout periods that insiders must.

In the UK issuers of securities and persons acting on their behalf must abide by specific rules regarding maintaining insider lists in prescribed forms. When a company implements a blackout period corporate insiders will not be allowed to buy and sell company shares during this period. A blackout period is an interval during which certain actions are limited or denied.

Blackout Periods. The typical trading window begins 2-3 trading days after the previous quarters earnings release. This Trading Blackout Period is a particularly sensitive period of time for transactions in the Companys stock from the perspective of compliance with US.

Seit 30 Jahren unterstützen wir Sie dabei so zu traden wie es zu Ihnen passt. What Is a Blackout Period. A blackout period in financial markets is a period of time when certain peopleeither executives employees or bothare prohibited from buying or selling shares in their company or making changes to their pension plan investments.

Black-Out Periods There is a mandatory 2 week blackout period for all employees of the Company prior to the release of quarterly and annual financial statements which shall continue until two trading days after the time such information has been released to the public. Typically this will occur when there are nonpublic developments that would be considered material for insider trading law purposes such as among other things developments relating to regulatory proceedings or a major corporate transaction. The Blackout Period is.

A blackout period is an interval during which certain actions are limited or denied. The blackout period will commence at the time that Sama becomes aware of material undisclosed information. It is most commonly used to prevent insider trading.

Blackout periods which are designed to prevent trading in a companys securities by insiders when they are most likely to possess material non-public information are a universal feature of insider trading policies. The blackout period will commence at the time that the Corporation becomes aware of material undisclosed information. Means any period of time during which directors are required to suspend trading in the Companys securities in accordance with the Companys Securities Trading Policy.

2 For more on that see here. Securities and Exchange Commission SEC has rules in place to prohibit insider trading during blackout periods. 7244a1 for any director or executive officer of an issuer of any equity security other than an exempt security directly or indirectly to purchase sell or otherwise acquire or transfer any equity security of the issuer other than an exempt security during.

Is It Against Insider Trading Rules If A Spouse Sells Cash Covered Options Or Spreads On The Stock That Is In A Blackout Period While Specifically Not In Possession Of Any Inside Knowledge

Insider Trading And Shareholder Investment Horizons Sciencedirect

Blackout Period Buyback Blackout Period Marks Another Possible Hurdle For Stocks Buyback Blackout

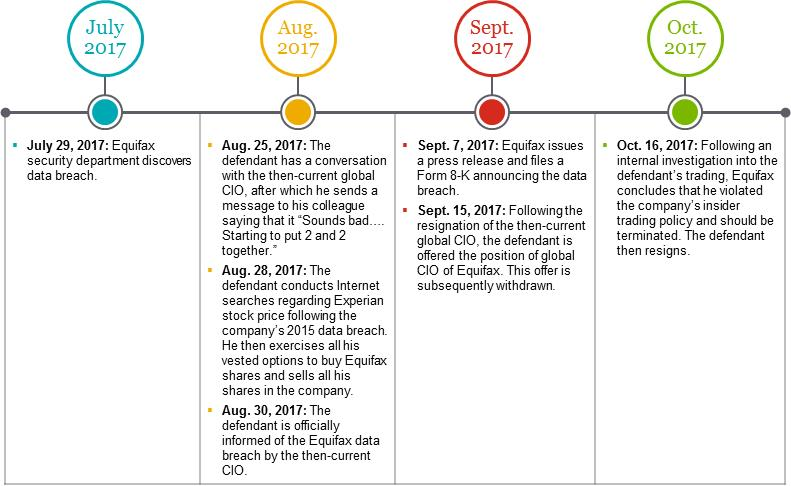

Equifax Insider Trading Charges Highlight Importance Of Tailored Policies And Controls Lexology

Pdf Insider Trading And Future Stock Returns In Firms With Concentrated Ownership Levels

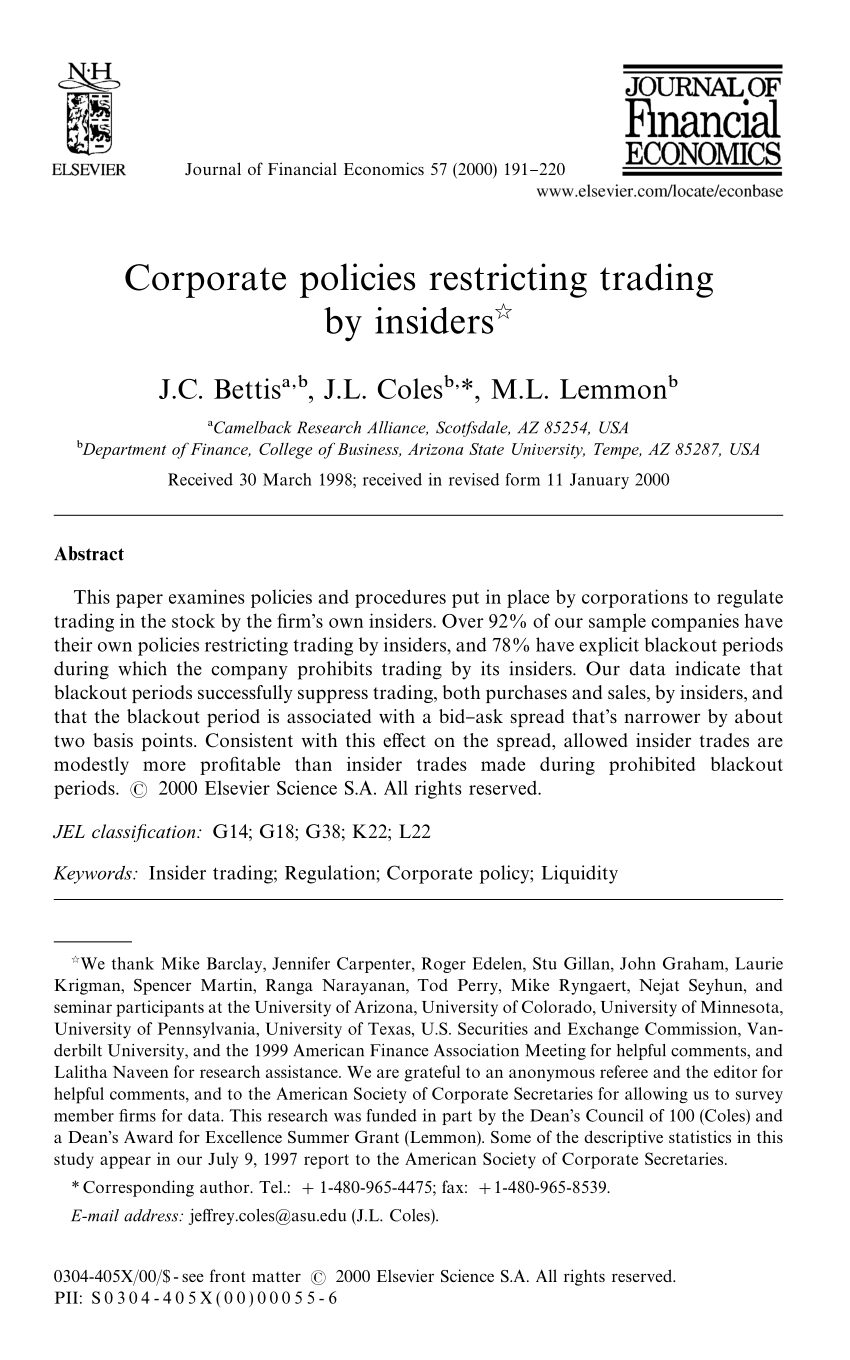

Pdf Corporate Policies Restricting Trading By Insiders

Pdf Corporate Policies Restricting Trading By Insiders

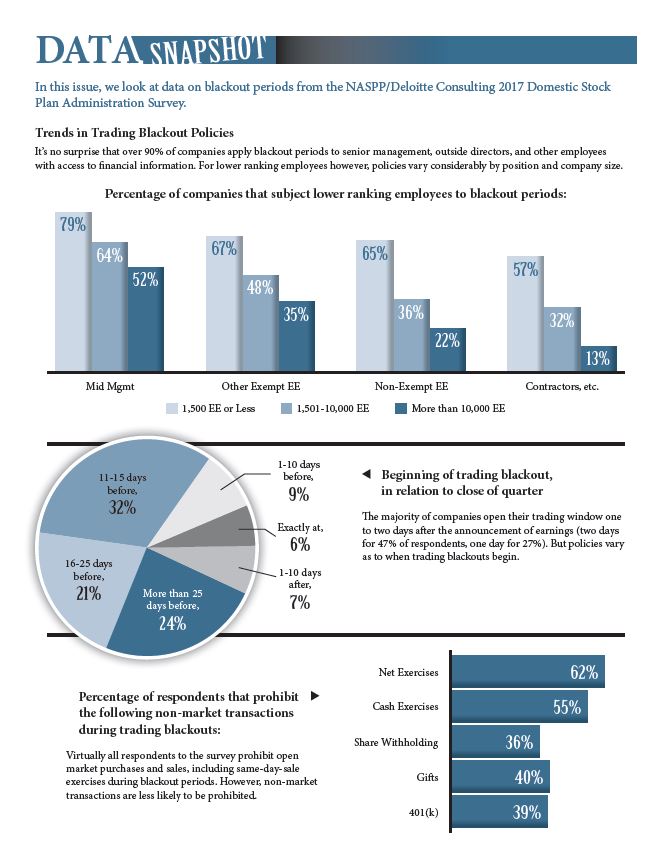

Insider Trading Policies What Companies Are Doing Thecorporatecounsel Net Blog

Things To Consider During Blackout And Quiet Periods Gilmartinir

Fraction Of Rms With Open Trading Windows On Trading Days In Calendar Download Scientific Diagram

Insider Trading Automation Riskpro India Connect With Risk Professionals

Profiting Off Pandemic The Sec Issues A Sharp Reminder About Companies Obligations Regarding Insider Trading And Mnpi Covid 19 Response Blog

I General The Insider Trading And Securities Fraud Enforcement Act

Postingan Populer

Gina Marie Designs Enamel Dots - Cactus Flower Matte Style Enamel Dots Gina Marie Designs Scrapbook Outlet Gina Marie Designs : This floor vase has soothing blue enamel and a tall shape make it a fluid piece that will tie your room together.

- Dapatkan link

- Aplikasi Lainnya

Black Widow Todesszene

- Dapatkan link

- Aplikasi Lainnya

Komentar

Posting Komentar